Spain is a key European market for pharmaceutical and healthcare research. The World Health Organization ranks Spain’s healthcare system as the seventh best in the world. Spain is also the world leader in organ transplants. Healthcare expenditures in Spain represent 8.5 percent of the GDP and spending per capita was US$3323.

The 2019 Bloomberg Healthiest Country Index, ranked Spain the healthiest country in the world. Life expectancy in Spain is the highest in Europe and the third highest globally behind Japan and Switzerland. By 2040, Spain is forecast to have the highest lifespan, of nearly 86 years and the aging population will play a significant role in driving Spain’s healthcare sector over the next several years.

The Healthcare System in Spain

The Sistema Nacional de Salud or SNS is a national health system based on the principles of universality, free access, equity, and fairness of financing. The system is laid down by law and applies throughout Spain constitutionally guaranteeing universal coverage with no out of pockets costs except for prescription drugs. Healthcare is either free or low-cost for residents paying social security and their dependents. The national healthcare system covers 99.7% of the Spanish population. The remaining 0.3% only has access to private medical care.

At a national level, the Interterritorial Council of the Spanish National Health Service, Consejo Interterritorial del Servicio Nacional de Salud de España (CISNS) seeks to provide cohesion for Spain’s healthcare services and guarantee the healthcare rights of citizens. It is responsible for certain strategic areas as well as for the overall coordination of the health system, and the national monitoring of performance. However, the healthcare system is mostly decentralized into Spain’s 17 Autonomous Communities. While this has advantages for the health system being able to operate closer to its end users and deliver customized regional solutions, it does result in differences in organization, reforms, priority setting, and DRG (Dangerous Goods Regulations) application. This decentralization, in turn, presents a market access challenge for the industry. Because each region can also vary significantly by culture, population and budget we advise conducting research regionally to gain local insights, particularly where new products are being

The SNS has been seeking to improve the healthcare information system information at all levels; notably, through the expansion of an Abridged Electronic Medical Record of clinical information among the Autonomous Communities, and through the development of the electronic prescription and a registry of professionals.

Healthcare is delivered via a network of public and private facilities. The private sector is an important player in the Spanish health system, providing voluntary health insurance schemes to individuals. The purchase of voluntary health insurance plans is mainly driven by faster access to some services. It is closely intertwined with the public sector; private facilities are contracted to the state to provide various services specifically, in hospital and pharmaceutical care. Not all private facilities are contracted to provide services under the SNS.

Hospitals

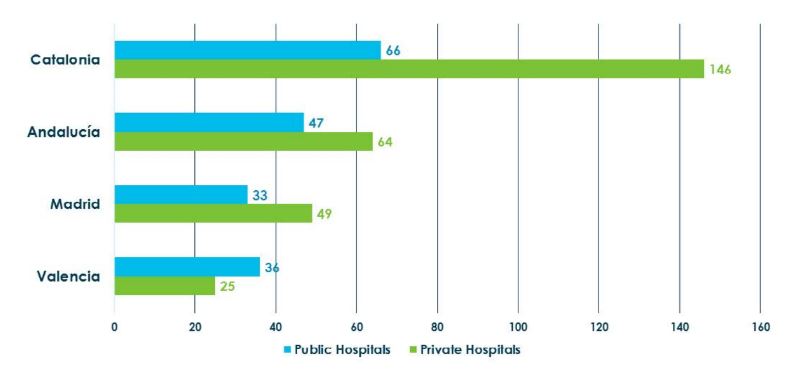

Spain boasts a network of high-quality hospitals and medical centers throughout the country. Catalonia, in particular, has a significantly high number of private hospitals.

Source: Statistica 2019

Pharmaceuticals

Spain today holds the position of the world’s tenth-largest pharmaceutical market, valued in 2017 at EUR 26.15 billion (USD 29.55 billion). This is a result of Spain’s economy maintaining a solid pace of expansion, significantly improved market access, high quality and affordable manufacturing capabilities, and a mature clinical research base. The period of austerity programs that forced price reductions and ejections from the reimbursement list is over, and once again, multinational pharmaceutical companies are viewing Spain as a top destination for investment.

In addition to market growth, positive change is also reflected in the level of product availability and the speed of products to market once approved by the European Medicines Agency (EMA) (which is now back in line with timeframes of leading markets.

- The buoyancy of the pharmaceutical industry can be attributed to a renewed collaboration agreement between the Spanish government and Farmaindustria, the Spanish pharmaceutical trade group. This accord seeks to reconcile three areas;

- Establishing business strength for pharmaceutical manufacturers

- Providing access for the public to the most advanced resources and therapeutic innovations available

- Creating favorable conditions for public expenditure (both from an efficiency and compliance standpoint) designed to sustain the health system.

According to the ESOMAR Global Research Report 2019, marketing research by pharmaceutical manufacturers represented 11% of research undertaken in Spain in 2018.

Pharmacies

The retail distribution of medicines is a tightly regulated activity in Spain, at both state and regional levels. Unlike other countries where doctors and hospitals play a significant role in dispensing medicines, the distribution of medicines in Spain is carried out mainly by pharmacies. There are around 22,000 Pharmacies in Spain. Pharmacies have the status of private healthcare establishments of public interest and, as such, are considered part of the healthcare system and are heavily regulated. In Madrid, for example, it’s regulated that a person can open a pharmacy for every 2,800 citizens. In rural areas, the number of people per pharmacy is lower. The ratio of pharmacies to population is very high – almost double the ratio in Germany.

In Spain, almost all medicines must be obtained at a pharmacy in contrast to many countries which means many people bypass their doctors and go straight to pharmacists for advice and treatment of minor ailments. Almost all pharmacies offer the same additional services: compounding, weight and blood pressure measurement, and cholesterol and glucose testing. The Spanish visits pharmacies for a range of products, such as baby foods, accessories, and medicine without prescription that would typically be bought in drug stores or supermarkets in other countries. Spain is quite unrestrictive when it comes to the distribution of medications that are strictly prescription drugs in other countries, so these are commonly available over-the-counter. Medicines tend to cost significantly less than in other countries due to state-imposed price restrictions.

In Spain, pharmacists are highly trained and must hold a degree in pharmacy because many medicines are available to buy over the counter without a prescription. Chain pharmacies, even the ownership of two pharmacies, is not permitted by law.

Doctors & Nurses

According to the OECD,

- In 2018, there were 5.7 nurses per 1000 inhabitants (compared to 7.8 in the UK and 11.7 in the US). This relatively low number of nurses can be attributed to the low level of nursing graduates and the considerably high level of migrations by nurses during the economic crisis.

- In 2017, there were 3.9 doctors per 1000 inhabitants (compared to 2.9 in the UK and 2.6 in the USA)

Payors and Pricing

Spain, in theory, is a single-payer healthcare system in that the government, rather than private insurers, covers all healthcare. The Directorate General for Pharmacy and Health Care Products (DGFPS) oversees pricing decisions. However, within the 17 regional Autonomous Communities, there are separate regional departments of health with primary jurisdiction over the delivery of regional healthcare and they each determine their own budgets and cap prices, and prescribe reimbursement guidelines.

National and regional taxes mainly finance the public system. Supplementary funding comes from co-payments for pharmaceuticals and outpatient care. Supporting the costs of treatments approved at the national level is a key responsibility for the regional payer authorities, and because of this, health expenditure is mainly determined by regional healthcare administrators.

The Spanish Agency of Medicines and Medical Devices (AEMPS) is the government’s highest power for authorizing medical products. Once authorized, new medicines are assessed by the Inter-Ministerial Pricing Commission for Pharmaceuticals (CIPM), which decides which new products will be included on the national reimbursement list and sets a maximum ex-factory price. (As a general rule, the price to be financed by the NHS will be lower than the industrial price of the medicine applied when it is dispensed outside the NHS.)

If the product is not approved, it will be added to the negative list in which case the price is determined by the manufacturer. In the case of innovative products, pricing is determined by referencing international pricing, and factors such as needs and budgets.

Medicines not financed by the NHS and not subject to medical prescription may be advertised to the public, and in this case, the price fixed to the packaging is the maximum retail price. Pharmacies may apply discounts of up to 10% of this retail price, including taxes.)

While payors can be national and regional, when recruiting payors, we would typically target autonomous regions. For secondary care level studies, the local level payors for hospital drugs are heads of pharmacy and the head budget controller of the clinical department. National professionals are typically members of DGFPS advisory committees. National Public administrators are, however, often not open to being interviewed.

Patients

Hard to reach patients can be recruited through a range of methods. Referrals from healthcare professionals or patient support groups can be a valuable solution. We have found that our extensive network of nurses is willing to cooperate on referrals as they have more direct contact with the patients. Patient support groups are also a good source for referrals, and their increasing presence on social media platforms increases the opportunity to connect with these groups.

Unlike the US, and like the rest of the EU, prescription medication is not advertised in Spain. Patients prescribed prescription medicine are not usually brand-aware, as doctors are expected to prescribe the standard drug in most cases.

Useful Links for Researchers

Conducting Marketing Research in Spain

Spanish National Hospital List 2017 (In Spanish)

BDI Research is an ISO-certified Sago company and has been a leader in qualitative and quantitative studies across Spain and Spanish-speaking countries for over 25 years.

To learn more about how BDI and Sago can help you gain answers to your important pharmaceutical and healthcare questions, contact our team:

For Studies in Spain: [email protected]

For Global Qualitative Studies: [email protected]

For Global Surveys: [email protected]

[email protected] | BDIResearch.com | Tel. +34 934 155 228

9 Minutes

9 Minutes